Indiana Free Legal Forms - A power of attorney in Indiana legally allows a person to choose an agent to represent matters related to finances, health care, minor children, and any customary arrangements. The only qualification for an agent is to be over the age of 18 and to recommend someone the person delegating can trust. For a power of attorney to be legal, it must be signed in accordance with state law.

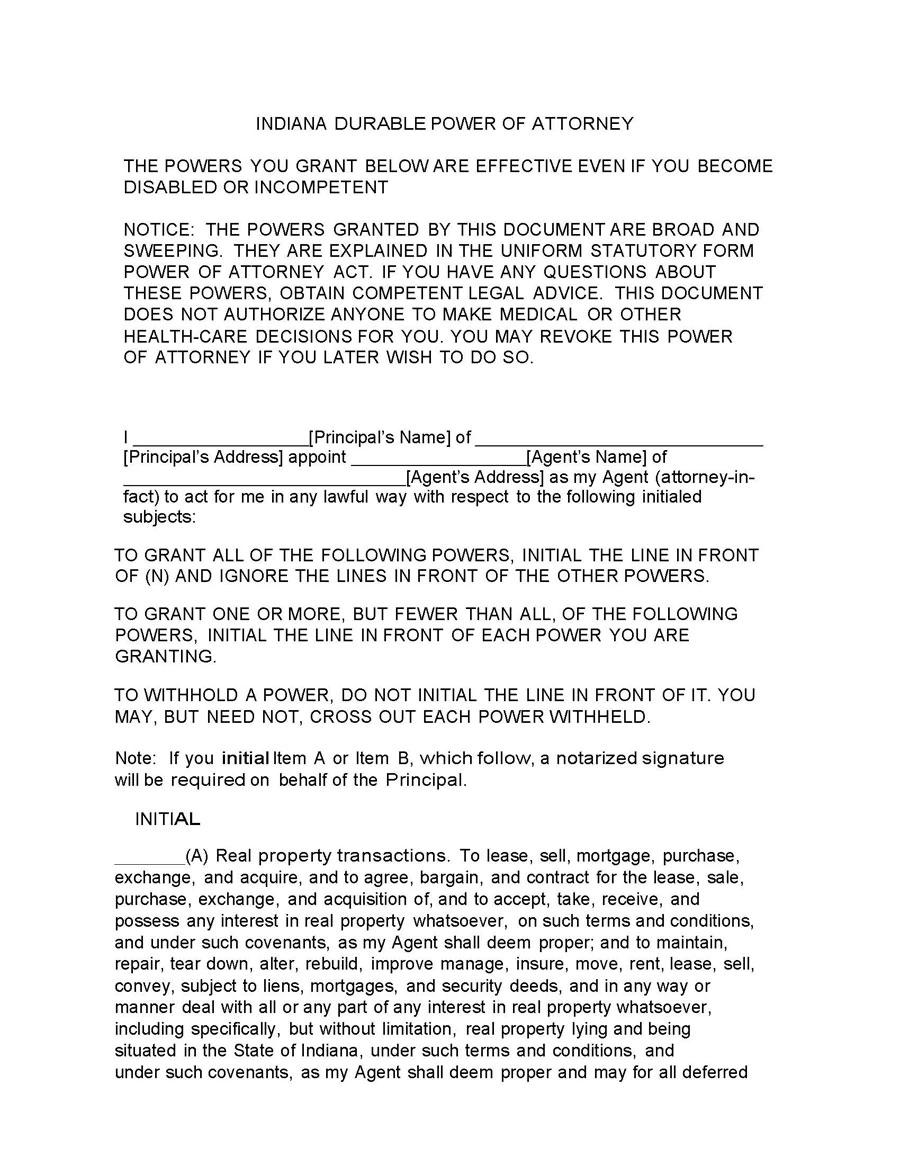

Enduring Power of Attorney (Financial) - Allows the grantor to appoint an agent to manage your financial and other interests, as set out in the document.

Indiana Free Legal Forms

General power of attorney (financial): Same as Lasting, but if the principal can no longer make his own decision, the document loses its validity.

Free Indiana Last Will And Testament Template

Living Will (Form 55316): For use with a living will to notify any hospital that the patient is requesting any means necessary to prolong his or her life.

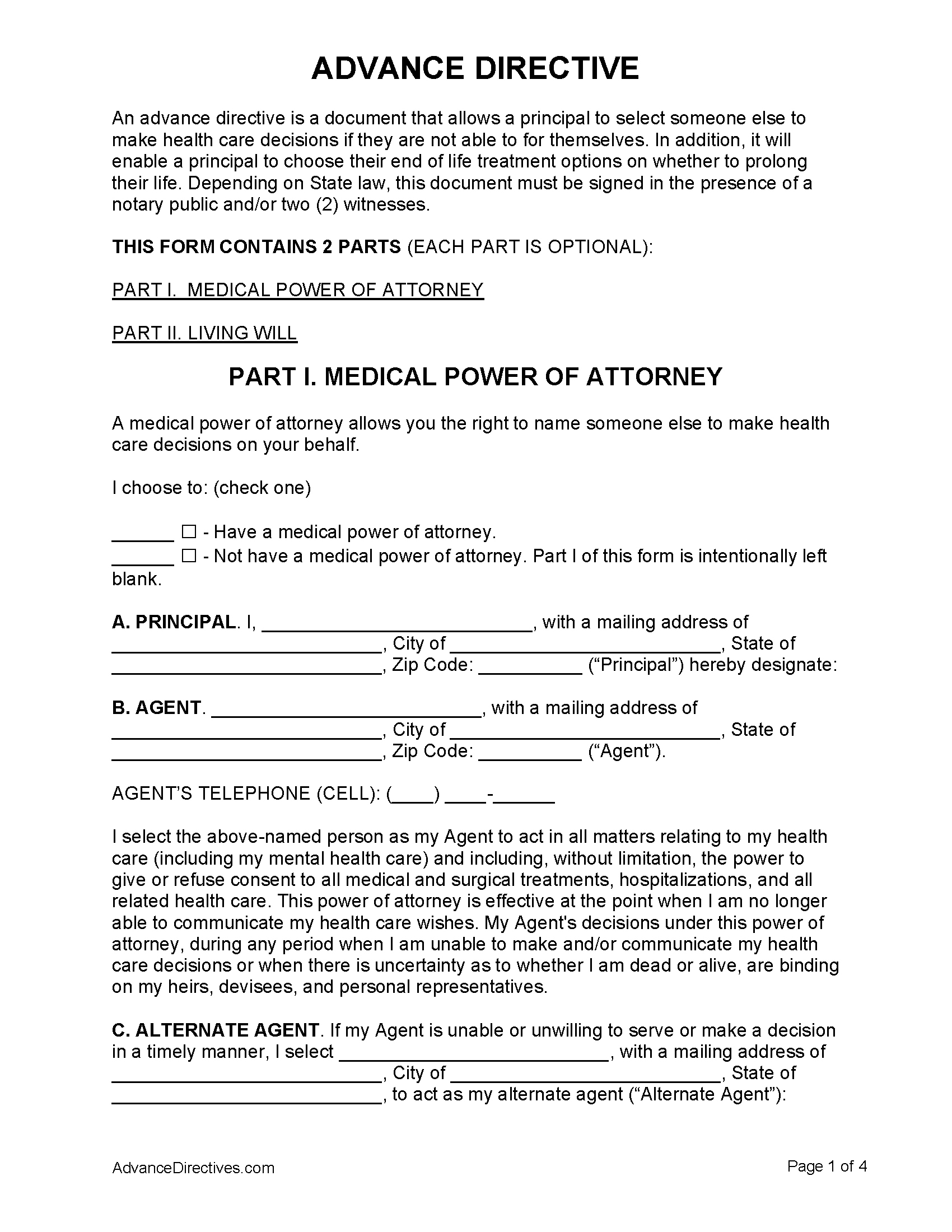

Medical Power of Attorney (Form 56184): Allows you to choose a person you trust to make health care decisions for you.

Power of attorney for minors (children): Allows a parent to designate someone to be the guardian of their children in the event that they are away for an extended period of time.

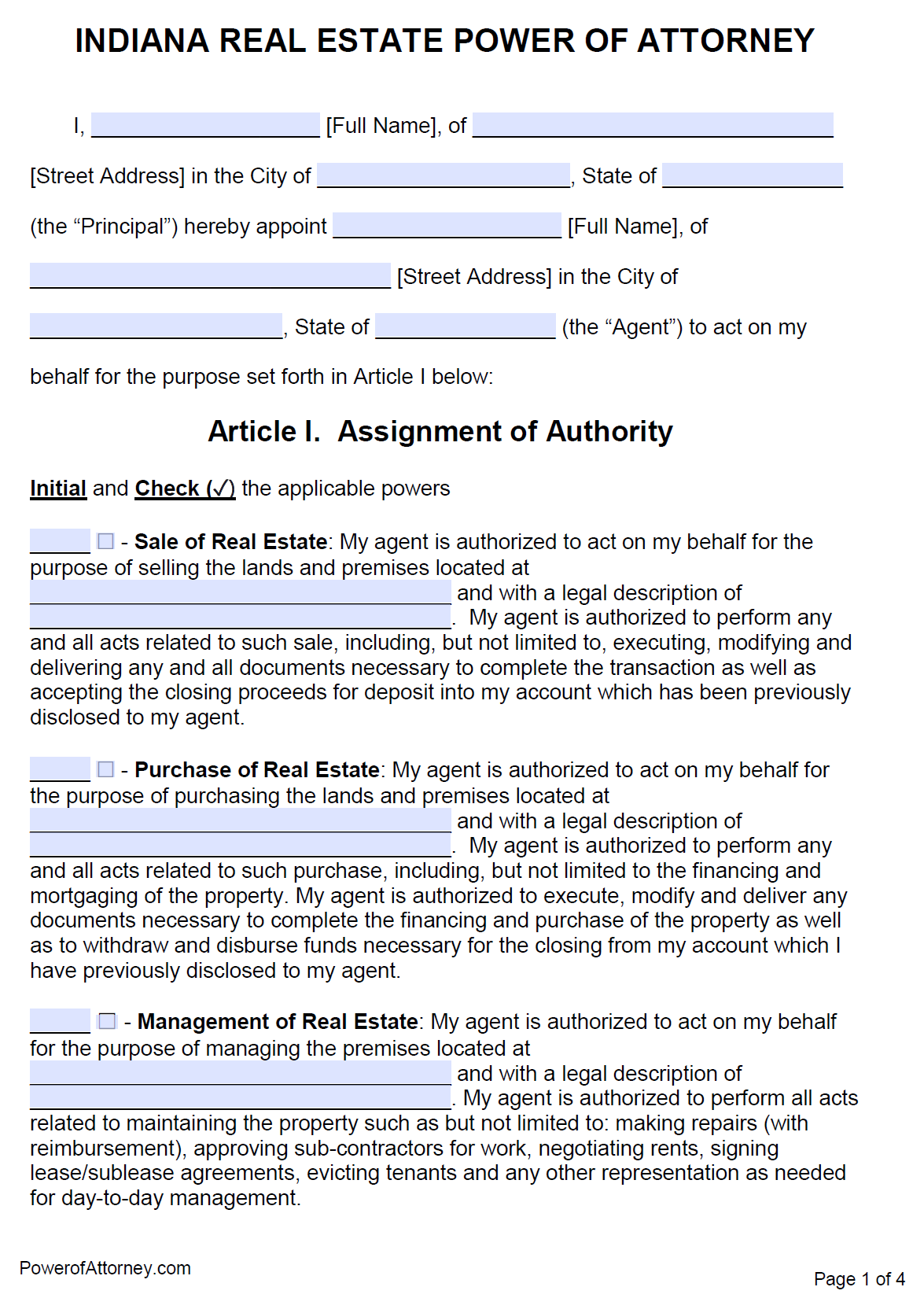

Real Estate Power of Attorney: A special request that allows only one person to manage the sale or control of real estate.

Free Indiana Bill Of Sale Forms

Tax power of attorney (Form 49357): Allows the principal to appoint someone to represent them before the tax authorities.

Power of attorney for vehicles (Form 01940) - use when you need someone to represent you before the Motor Vehicle Institute.

By using the website, you agree to our use of cookies to analyze website traffic and improve your experience on our website. Indiana power of attorney forms allow individuals to designate representatives to handle their finances and health care decisions. Using durable power of attorney and living will (medical power of attorney) forms, agents can be given authority to act on behalf of the principal in the event of his or her incapacity. The purpose of this is to ensure that the director is taken care of and that his wishes are met during any period of disability. In addition to authorizing financial and health care agents, power of attorney forms are commonly used in entering into contracts with third parties to file taxes or sell property on behalf of the principal.

An Indiana Lasting Power of Attorney form is a document by which a person (principal) can authorize an agent (power of attorney) to act on their behalf during their lifetime and in the event of their incapacity or death. This authorization is primarily used to make financial decisions in the interest of the client. In Illinois, there are no restrictions on who can designate a person as their…

Free Indiana Lease Agreements (6)

The Indiana Medical Power of Attorney, also known as "Form 56184," is used to appoint a health care agent to make medical decisions on behalf of the principal in the event of incapacity. It is important that people choose someone who can be locally available to meet with the director's health professionals and share their core values about health care. Therefore, many people choose their spouse to…

The Indiana General Power of Attorney form gives a third party the authority to act on behalf of the principal in any type of financial decision in the state. The difference between this designation and a durable power of attorney is that this document is void if the principal becomes incapacitated. You do not need to sign the form in front of any witnesses to…

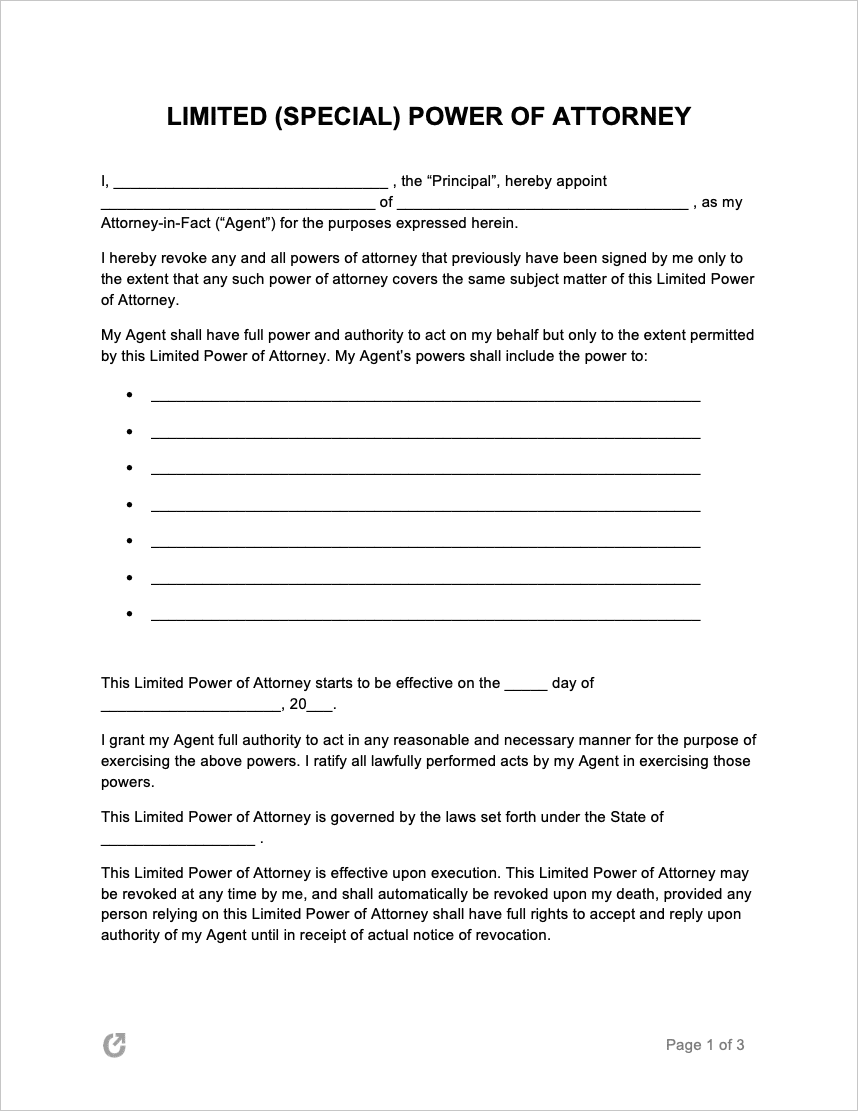

The Indiana Limited Power of Attorney form is used to appoint an agent who is authorized to act on specific decisions for the principal. Allowable decisions can be anything from paying bills to buying or selling a home for the benefit of the principal. All income (if any) must go to the principal. Signature Requirements (§ 30-5-4-1) - Principal...

The Indiana Tax Power of Attorney form allows residents to hire a third party to file taxes with the Department of Revenue on their behalf. Also known as a "POA - 1" form, it is recommended that you submit the document to a CPA (Certified Public Accountant) or tax attorney as this will ensure that he or she has some knowledge of the tax system in...

Oaq General Source Data Application Gsd 09 Summary Of Additional Information{51611}

The Indiana Vehicle/Watercraft Power of Attorney (Form 1940) allows a person to designate another party to handle the sale of the vehicle on their behalf. All proceeds and turnover must be in favor of the seller (principal) and must be signed before a notary public before they can be used. The document is valid for ninety (90) days from the date of the seal at the notary....

The Indiana Power of Attorney form for a minor child (child) allows a parent to choose a representative and give him or her the authority to take actions and make decisions regarding the minor child. A power of attorney allows the representative to act as a parent to ensure proper care and custody of the minor. In Indiana, parental rights can remain in effect for a maximum of twelve…

An Indiana real estate power of attorney is a document specifically used to grant certain real estate powers to an agent. The principal, the person executing the document, can use the form provided to select all powers of attorney he wishes to give to his agent. Examples of an agent's duties may include property sales and purchases, refinancing, mortgages and deeds, and general real estate...

By using this website, you agree to our use of cookies to analyze web traffic and improve your experience on our website. OK IN CONSIDERATION of the mutual promises and covenants contained in this Agreement, as well as other valuable considerations, the acceptance and sufficiency of which is hereby acknowledged, the Parties agree as follows:

Free Indiana Marital Separation Agreement

I, attorney, within and for the said counties and states, certify that on this day ________________, personally known to me, whose name is signed on the above Separation Agreement, have appeared before me and I therefore certify their signatures on this Separation Agreement. and that ________________ has entered into this separation agreement of his own free will and will without force or coercion from any party.

I, attorney, within and for the said counties and states, certify that on this day ________________, personally known to me, whose name is signed on the above Separation Agreement, have appeared before me and I therefore certify their signatures on this Separation Agreement. and that ________________ has entered into this separation agreement of his own free will and will without force or coercion from any party.

THAT I have been consulted today in my professional capacity by ________________, named in the instrument within, which is the Separation Agreement, separate and apart from ________________, regarding their legal rights and responsibilities under the terms and conditions and that I have acted solely on his behalf , and I have fully explained to him the nature and effect of this foregoing separation agreement and he has executed it in my presence, and he has acknowledged and declared that he is executing it of his own free will and without any fear, threat, coercion or influence of ________________ or any what other person.

THAT I have been consulted today in my professional capacity by ________________, named in the instrument within, which is the Separation Agreement, separate and apart from ________________, regarding their legal rights and responsibilities under the terms and conditions and that I have acted solely on her behalf, and I have fully explained to her the nature and effect of this foregoing separation agreement and she has executed it in my presence and she has acknowledged and declared that she is executing it of her own free will and without any fear, threat, coercion or influence of ________________ or any another person.

Free South Dakota Bill Of Sale Forms (5)

Legal separation is allowed and recognized in Indiana. In most cases, parties will use it to protect marital assets in the case of couples who abuse substances. In this case, it gives the lawyer enough time to start working on the divorce if the other party in the marriage feels that they can no longer bear their spouse's behavior. If there is any hope of working things out, this is the perfect opportunity for both parties.

The other main reason for filing a divorce agreement in Indiana is to notify creditors of the status of the marriage. In this case, an absolute divorce is inevitable, so creditors can take steps to collect while they still can.

There are still other reasons a couple may choose to divorce instead of divorce, including religious beliefs that may prohibit dissolution of marriage.

Generally, legal separation follows the same procedure as divorce. The Indiana Divorce Agreement will be filed by the filing party and then reviewed by a judge to decide if it is fair and equitable. Some of the things the agreement will deal with include child support and custody, division of assets and responsibilities, and sometimes alimony. Once the court order takes effect, the marital estate will be closed. Legal separation expires one year after

Transfer Death Indiana: Fill Out & Sign Online

Us legal forms free, free legal forms alabama, free legal forms indiana, free legal guardianship forms indiana, free legal forms pdf, legal forms indiana, free legal forms tennessee, free legal forms online, blank legal forms free, legal guardianship forms indiana, indiana state legal forms, indiana legal separation forms

0 Comments